Jay Madhu

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14A-101)

INFORMATION REQUIRED IN PROXY STATEMENT

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

| Filed by the Registrant ☒ | Filed by a Party other than the Registrant ☐ |

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material under §240.14a-12 |

| OXBRIDGE RE HOLDINGS LIMITED |

| (Name of Registrant As Specified in its Charter) |

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

☒ | No fee required. |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

OXBRIDGE RE HOLDINGS LIMITED

Suite 201, 42 Edward Street

P.O. Box 469

Grand Cayman, KY1-9006

Cayman Islands

NOTICE OF ANNUAL GENERAL MEETING OF SHAREHOLDERS

TO BE HELD ON JUNE 1, 202314, 2024

Notice is hereby given that the Annual General Meeting of Shareholders (the “Meeting”) of Oxbridge Re Holdings Limited (the “Company”) will be held at the Company’s office, Suite 201, 42 Edward Street, George Town, Cayman Islands on Thursday,Friday, June 1, 2023,14, 2024, at 3:9:00 p.m.a.m. (local time), for the following purposes:

| 1. | To consider and vote upon a proposal to elect five directors to serve on the Board of Directors of the Company until the Annual General Meeting of Shareholders of the Company in |

| 2. | To consider and vote upon a proposal to ratify the appointment of Hacker, Johnson & Smith, P.A., as the independent auditors of the Company for the fiscal year ending December 31, |

| 3. |

|

| To transact such other business that may properly come before the meeting or any adjournments or postponements thereof. |

Information concerning the matters to be acted upon at the Meeting is set forth in the accompanying Proxy Statement.

Only shareholders of record, as shown by the transfer books of the Company, at the close of business on April 24, 2023,15, 2024, will be entitled to notice of, and to vote at, the Meeting or any adjournments or postponements thereof. Whether or not you plan to attend the Meeting, we hope you will vote as soon as possible. Voting your proxy will ensure your representation at the Meeting. We urge you to carefully review the proxy materials and to vote FOR the above proposals.

| By Order of the Board of Directors, | |

Jay Madhu | |

| Chief Executive Officer | |

| April | |

| Grand Cayman, Cayman Islands |

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE

SHAREHOLDER MEETING TO BE HELD ON JUNE 1, 2023:14, 2024:

To access our Proxy Statement and our Annual Report to Shareholders,

please visit www.oxbridgere.com/2023AGM2024AGM

TABLE OF CONTENTS

OXBRIDGE RE HOLDINGS LIMITED

Suite 201

42 Edward Street

P.O. Box 469

Grand Cayman, KY1-9006

Cayman Islands

PROXY STATEMENT

ANNUAL GENERAL MEETING OF SHAREHOLDERS

TO BE HELD ON JUNE 1, 202314, 2024

This Proxy Statement is furnished in connection with the solicitation by the Board of Directors of Oxbridge Re Holdings Limited (the “Company”) of proxies for use at the Annual General Meeting of Shareholders of the Company (the “Meeting”) to be held at the Company’s office, Suite 201, 42 Edward Street, George Town, Cayman Islands on ThursdayFriday June 1, 202314, 2024 at 3:9:00 p.m.a.m. (local time), and at any and all adjournments or postponements thereof, for the purposes set forth in the accompanying Notice of Annual General Meeting of Shareholders. The Company’s Annual Report to Shareholders is included with this Proxy Statement for informational purposes and not as a means of soliciting your proxy.

This Proxy Statement and the accompanying proxy card and Notice of Annual General Meeting of Shareholders are expected to be provided to shareholders on or about May 6, 2023.2024.

Matters to be Voted Upon at the Meeting

You are being asked to consider and vote upon the following proposals:

| 1. | To elect five directors to serve on the Board of Directors of the Company (our “Board”) until the Annual General Meeting of Shareholders of the Company in |

| 2. | To ratify the appointment of Hacker, Johnson & Smith, P.A., as the independent auditors of the Company for the fiscal year ending December 31, |

Voting Procedures

As a shareholder of the Company, you have a right to vote on certain matters affecting the Company. The proposals that will be presented at the Meeting and upon which you are being asked to vote are discussed above. Each ordinary share of the Company you owned as of the record date, April 24, 2023,15, 2024, entitles you to one vote on each proposal presented at the Meeting, subject to certain provisions of our Third Amended and Restated Memorandum and Articles of Association (our “Articles”), as described below under “Voting Securities and Vote Required.”

Methods of Voting

You may vote by mail, by telephone, over the Internet or in person at the Meeting.

Voting by Mail. You may vote by signing the proxy card and returning it in the prepaid and addressed envelope enclosed with the proxy materials. If you vote by mail, we encourage you to sign and return the proxy card even if you plan to attend the Meeting so that your shares will be voted if you are unable to attend the Meeting.

Voting by Telephone. To vote by telephone, please follow the instructions included on your proxy card. If you vote by telephone, you do not need to complete and mail a proxy card. Telephone voting is available through 11:59 p.m. (local time) on May 31, 2023,June 13, 2024, the day prior to the Meeting day.

| 1 |

Voting over the Internet. To vote over the Internet, please follow the instructions included on your proxy card. If you vote over the Internet, you do not need to complete and mail a proxy card. Internet voting is available through 11:59 p.m. (local time) on May 31, 2023,June 13, 2024, the day prior to the Meeting day.

Voting in Person at the Meeting. If you attend the Meeting and plan to vote in person, we will provide you with a ballot at the Meeting. If your shares are registered directly in your name, you are considered the shareholder of record and you have the right to vote in person at the Meeting. If your shares are held in the name of your broker or other nominee, you are considered the beneficial owner of shares held in street name. As a beneficial owner, if you wish to vote at the Meeting, you will need to bring to the Meeting a legal proxy from your broker or other nominee authorizing you to vote those shares.

VOTING SECURITIES AND VOTE REQUIRED

As of April 24, 2023,15, 2024, the record date for the determination of persons entitled to receive notice of, and to vote at, the Meeting (the “Record Date”), 5,870,2346,006,661 ordinary shares were issued and outstanding. The ordinary shares are our only class of equity securities outstanding and entitled to vote at the Meeting. There is no cumulative voting.

Subject to the provisions of the Articles, each ordinary share is entitled to one vote per share. However, under the Articles, the Board shall reduce the voting power of any holder that holds 9.9% or more of the total issued and outstanding ordinary shares (such person, a “9.9% Shareholder”) to the extent necessary such that the holder ceases to be a 9.9% Shareholder. In connection with this reduction, the voting power of the other shareholders of the Company may be adjusted pursuant to the terms of the Articles. Accordingly, certain holders of ordinary shares may be entitled to more than one vote per share subject to the 9.9% restriction in the event that our Board is required to make an adjustment on the voting power of any 9.9% Shareholder.

Voting Reduction

The applicability of the voting power reduction provisions to any particular shareholder depends on facts and circumstances that may be known only to the shareholder or related persons. Accordingly, we request that any holder of ordinary shares with reason to believe that it is a 9.9% Shareholder contact us promptly so that we may determine whether the voting power of such holder’s ordinary shares should be reduced. By submitting a proxy, a holder of ordinary shares will be deemed to have confirmed that, to its knowledge, it is not, and is not acting on behalf of, a 9.9% Shareholder.

The directors of the Company are empowered to require any shareholder to provide information as to that shareholder’s beneficial ownership of ordinary shares, the names of persons having beneficial ownership of the shareholder’s ordinary shares, relationships with other shareholders or any other facts the directors may consider relevant to the determination of the number of ordinary shares attributable to any person. The directors may disregard the votes attached to ordinary shares of any holder who fails to respond to such a request or who, in their judgment, submits incomplete or inaccurate information.

The directors retain certain discretion to make such final adjustments that they consider fair and reasonable in all the circumstances as to the aggregate number of votes attaching to the ordinary shares of any shareholder to ensure that no person shall be a 9.9% Shareholder at any time.

Quorum; Vote Required

The attendance of two or more persons representing, in person or by proxy, more than 50% in par value of the issued and outstanding ordinary shares as of the Record Date, is necessary to constitute a quorum at the Meeting.

Assuming that a quorum is present, the affirmative vote of the holders of a simple majority of the issued and outstanding ordinary shares voted at the Meeting is required for election of each of the director nominees in Proposal One and for the approval of Proposal Two. Proposals Three and Four are advisory and non-binding on the Company. However, our Board and Compensation Committee will review voting results on these proposals and will give consideration to such voting.

With regard to any proposal or director nominee, votes may be cast in favor of or against such proposal or director nominee or a shareholder may abstain from voting on such proposal or director nominee. Abstentions will be excluded entirely from the vote and will have no effect except that abstentions and “broker non-votes” will be counted toward determining the presence of a quorum for the transaction of business.

Generally, broker non-votes occur when ordinary shares held by a broker for a beneficial owner are not voted on a particular proposal because the broker has not received voting instructions from the beneficial owner, and the broker does not have discretionary authority to vote on a particular proposal. Proposal One Proposal Three, and Proposal Four are eachis considered a non-discretionary matter, and a broker will lack the authority to vote uninstructed shares at their discretion on such proposal. Proposal Two is considered a discretionary matter, and a broker will be permitted to exercise its discretion to vote uninstructed shares on this proposal.

Recommendation

Our Board recommends that the shareholders take the following actions at the Meeting:

| 1. | Proposal One: to vote FOR the election of each of the five director nominees to serve on the Board until the Annual General Meeting of Shareholders of the Company in | |

| 2. | Proposal Two: to vote FOR the ratification of the appointment of Hacker, Johnson & Smith, P.A., as the independent auditors of the Company for the fiscal year ending December 31, | |

Proxies must be received by us by 11:59 p.m. (local time) on May 31, 2023,June 13, 2024, the day prior to the Meeting day.date of the Meeting. A shareholder may revoke his or her proxy at any time up to one hour prior to the commencement of the Meeting.

To do this, you must:

| ● | enter a new vote by telephone, over the Internet or by signing and returning another proxy card at a later date; | |

| ● | file a written revocation with the Secretary of the Company at our address set forth above; | |

| ● | file a duly executed proxy bearing a later date; or | |

| ● | appear in person at the Meeting and vote in person. |

A shareholder of record may revoke a proxy by any of these methods, regardless of the method used to deliver the shareholder’s previous proxy. If your ordinary shares are held in street name, you must contact your broker, dealer, commercial bank, trust company or other nominee to revoke your proxy.

The individuals designated as proxies in the proxy card are officers of the Company.

All ordinary shares represented by properly executed proxies that are returned, and not revoked, will be voted in accordance with the instructions, if any, given thereon. If no instructions are provided in an executed proxy, it will be voted FOR the election of each director nominee named in Proposal One and FOR Proposal Two, Proposal Three, and Proposal Four and in accordance with the proxy holder’s best judgment as to any other business that may properly come before the Meeting. If a shareholder appoints a person other than the persons named in the enclosed form of proxy to represent him or her, such person should vote the shares in respect of which he or she is appointed proxy holder in accordance with the directions of the shareholder appointing him or her.

ELECTION OF DIRECTORS OF THE COMPANY

Our Articles currently provide that our Board shall consist of not less than four (4) directors (exclusive of alternate directors). We currently have five directors serving on our Board, and our Board has nominated those five directors – Jay Madhu, Dwight Merren, Arun Gowda, Wrendon Timothy and Lesley Thompson– for re-election as directors to serve until the Annual General Meeting of Shareholders of the Company in 2024.2025.

Our Board has no reason to believe that any of these director nominees will not continue to be a candidate or will not be able to serve as a director of the Company if elected. In the event that any nominee is unable to serve as a director, the proxy holders named in the accompanying proxy have advised that they will vote for the election of such substitute or additional nominee(s) as our Board may propose. Our Board unanimously recommends that you vote FOR the election of each of the nominees.

Director Nominees

Each of the director nominees is currently serving as a director of the Company and is standing for re-election. There is no family relationship among any of the directors and/or executive officers of the company. Unless otherwise directed, the persons named in the proxy intend to vote all proxies FOR the election of each of the following director nominees:

| Name | Age | Position | Director Since | Age | Position | Director Since | ||||||

| Jay Madhu(3)(5) | 56 | Chairman of the Board of Directors, Chief Executive Officer, and President | 2013 | 57 | Chairman of the Board of Directors, Chief Executive Officer, and President | 2013 | ||||||

| Dwight Merren(1)(2)(4) | 57 | Director | 2022 | 58 | Director | 2022 | ||||||

| Arun Gowda(1)(2)(4)(5) | 57 | Director | 2023 | 58 | Director | 2023 | ||||||

| Wrendon Timothy(3)(5) | 42 | Director | 2021 | 43 | Director | 2021 | ||||||

| Lesley Thompson(1)(2)(3)(4) | 51 | Director | 2021 | 52 | Director | 2021 | ||||||

(1) Member of Audit Committee.

(2) Member of Compensation Committee.

(3) Member of Underwriting Committee.

(4) Member of Nominating and Corporate Governance Committee.

(5) Member of Investment Committee.

The nominees have consented to serve as directors of the Company if elected.

Set forth below is biographical information concerning each nominee for election as a director of the Company, including a discussion of such nominee’s particular experience, qualifications, attributes or skills that led our Nominating and Corporate Governance Committee and our Board to conclude that the nominee should serve as a director of our Company.

Jay Madhu. Mr. Madhu is a founder of our company. He has served as our Chief Executive Officer and President, and as a director of our Company, since April 2013, and has served as Chairman of the Board since January 2018. Mr. Madhu also serves as a director of Oxbridge Reinsurance Limited and Oxbridge Re NS, the wholly owned licensed reinsurance subsidiaries of our Company. SinceBeginning in 2021, Mr. Madhu has served as the Chairman of the Board, Chief Executive Officer and President of Oxbridge Acquisition Corp. (“OXAC”) until the consummation of the business combination with Jet.AI Inc. (NASDAQ: OXAC)JTAI) in August 2023. He has also served as the Chairman of the Board, Chief Executive Officer and its sponsor,President of OAC Sponsor Ltd., formerly the sponsor of OXAC, since 2021. Mr. Madhu has also been a director of HCI Group, Inc. (NYSE: HCI), a publicly traded holding company owning subsidiaries primarily engaged in the property and casualty insurance business, since May 2007. He also served as the President of Greenleaf Capital, the real estate division of HCI Group, Inc., from June 2011 through June 2013 and as Vice President of Investor Relations for HCI Group, Inc. from February 2008 through June 2013. Mr. Madhu also served as Vice President of Marketing for HCI Group, Inc. from 2008 to 2011. In his various positions at HCI Group, Inc., Mr. Madhu’s responsibilities included marketing, investor relations and management and oversight of HCI Group’s real estate division. He has also been a director of HCI Group’s wholly owned subsidiary, Claddaugh Casualty Insurance Company Ltd (“Claddaugh”), since July 2010. From August 2013 to April 2014, Mr. Madhu has served on the board of directors of BayFirst Financial Corp. (NASDAQ: BAFN) a bank holding company in Seminole, Florida. Mr. Madhu also served on the board of directors of Wheeler Real Estate Investment Trust, Inc. (NASDAQ: WHLR), a publicly held real estate investment trust, from 2012 to June 2014. As an owner and manager of commercial properties, Mr. Madhu has been President of 5th Avenue Group LC, a real estate management company, from 2002 to 2020 and was President of Forrest Terrace LC, a real estate management company, from 1999 until 2010. In addition, Mr. Madhu is an investor in banking and health maintenance organizations. He was also President of The Mortgage Corporation Network (correspondent lenders) from 1996 to 2011. Prior to that, Mr. Madhu was Vice President, mortgage division, at First Trust Mortgage & Finance, from 1994 to 1996; Vice President, residential first mortgage division, at Continental Management Associates Limited, Inc., from 1993 to 1994; and President, S&S Development, Inc. from 1991 to 1993. He attended Northwest Missouri State University, where he studied marketing and management.

Mr. Madhu is an approved director with Cayman Islands Monetary Authority, Bermuda Monetary Authority, Florida Office of Insurance Regulation, Arkansas Insurance Department, California Department of Insurance, Maryland Insurance Administration, New Jersey Department of Banking and Finance, North Carolina Department of Insurance, Ohio Department of Insurance, Pennsylvania Insurance Department and South Carolina Department of Insurance. Mr. Madhu attended Northwest Missouri State University where he studied marketing and management. Mr. Madhu brings considerable business and capital markets experience to our Board of Directors.

Mr. Madhu brings considerable business, capital markets and marketing experience to our Board.

Dwight Merren. Mr. Merren has been a director of our Company since November 2022. He currently serves as an AVP, , Private Banking at Butterfield Bank (Cayman) Limited (“Butterfield Cayman”) since December 2021, servicing mainly high net-worth private clientele Butterfield Cayman is part of the Butterfield Group (NYSE: NTB). Prior to this, from November 2014, Mr. Merren served as a Relationship Manager in Butterfield’s Corporate Banking Department where he was responsible for the management of a portfolio of corporates across various business sectors, including captive insurers, insurance companies, reinsurance companies, special-purpose vehicles, liquidation accounts, large multinational companies and hedge funds. Mr. Merren previously served as Relationship Manager of HSBC Bank (Cayman) Limited from October 2011 to October 2014, and as Deputy Head – Insurance Division at CIMA, from March 2009 to September 2011. From July 1992 to February 2009, Mr. Merren held senior roles of Administrator at Midland Bank (now HSBC), Assistant Vice President at Willis Management (Cayman) Limited, and Vice President at Global Captive Management Ltd. where he led and managed large portfolio of companies. Mr. Merren served as an independent director at Cayman Islands National Insurance Company (“CINICO”), and as the Chairman of the Risk and Compliance Committee, and Chair of the Finance Committee from November 2017 to February 2022.

Mr. Merren brings invaluable experience in insurance, banking, risk management, compliance and governance to our Board.

Arun Gowda. Mr. Gowda has been a director of our Company since January 2023. He serves as the Managing Partner of Broadpeak Ventures since January 2018. In his role, Mr. Gowda oversees and manages investment and business development with early-stage venture companies in asset management, insurance and alternative investment strategies. Mr. Gowda served as the Managing Director, UBS O’Connor at New York, an alternative investment arm UBS Group AG (NYSE: UBS) from September 2016 to December 2017, where he was responsible for raising funds for private credit and hedge funds. From February 2012 to December 2015, Mr. Gowda served as Managing Director at Guggenheim Investments, New York, where he was responsible for development of the alternative investment platform for institutional investors including pension funds, insurance companies and private banks. From August 1993 to December 2011, Mr. Gowda held senior roles of Vice President at Morgan Stanley, New York (NYSE: MS), Executive Director at UBS Investment Bank, London (NYSE: UBS) and Partner at Eventi Capital Partners, Toronto, where he managed investments in private companies in technology, medical device, and alternatives. Mr. Gowda serves as a director on Ide8 Re, a Bermuda captive reinsurer for insurtech Bamboo Insurance from April 2021 through to present.its acquisition in January 2024. Mr. Gowda also serves as an advisor to the management of Aquarian Holdings and Osprey Funds from January 2019 and May 2021, respectively. Mr. Gowda currently serves as a director of Generational Re (ISAC) Limited Bermuda, a Bermuda-based life and annuity insurer. Mr. Gowda holds an MBA in Finance from The Wharton School, University of Pennsylvania, and a Bachelor’s Degree with Distinction in Electrical Engineering, Computer Science and Math from Vanderbilt University.

Mr. Gowda brings invaluable experience in investments, hedge funds, insurance and reinsurance products, and experience in fund raise and scaling businesses to our Board.

Wrendon Timothy. Mr. Timothy has been a director of our Company since November 2021. Mr. Timothy has served as the Chief Financial Officer and Corporate Secretary of our Company since August 2013. In his role, he has provided financial and accounting consulting services with a focus on technical and SEC reporting, compliance, internal auditing, corporate governance, mergers & acquisitions analysis, risk management, and CFO and controller services. Mr. Timothy also serves as an executive and director of Oxbridge Reinsurance Limited and Oxbridge Re NS, the wholly-owned licensed reinsurance subsidiaries of Oxbridge Re. Mr. Timothy servesserved as the Chief Financial Officer, Treasurer, Secretary and director of Oxbridge Acquisition Corp. (NASDAQ: OXAC)from April 2021 until the business combination with Jet.AI Inc. in August 2023, and its sponsor, OAC Sponsor Ltd. from April 2021 to present. Mr. Timothy also serves as a director of SurancePlus Inc., a British Virgin Islands wholly-owned Web3 subsidiary of our Company.

Mr. Timothy started his financial career at PricewaterhouseCoopers (Trinidad) in 2004 as an Associate in their assurance division, performing external and internal audit work, and tax-related services. Throughout his career progression and transitions through KPMG Trinidad and PricewaterhouseCoopers (Cayman Islands), Mr. Timothy has successfully delivered services across both the public and private sectors. Mr. Timothy management roles allowed him to be heavily involved in the planning, budgeting, and leadership of engagement teams, serving as a liaison for senior client management, and advising on technical accounting matters. Mr. Timothy is a Fellow of the Association of Chartered Certified Accountants (ACCA), a Chartered Corporate Secretary and also holds a Postgraduate Diploma in Business Administration and a Master of Business Administration, with Distinction (with a Specialism in Finance (with Distinction)), from Heriot Watt University in Edinburg, Scotland. Mr. Timothy holds directorship and leadership roles with a number of privately-held companies, and also serves on various not-for-profit organizations, including his governance role as Chairman of Audit & Risk Committee of The Utility Regulation & Competition Office of the Cayman Islands from May 2021 to December 2022.2022, and June 2023 to present. Mr. Timothy also serves as lead independent director and member of the Audit, Compensation, and Nominating and Corporate Governance Committees of Jet.AI Inc. (NASDAQ: JTAI). Mr. Timothy is an active Fellow Member of the ACCA, an active member of the Cayman Islands Institute of Professional Accountants (CIIPA), and an active Fellow Member of the Chartered Governance Institute (formerly the Institute of Chartered Secretaries and Administrators).

Mr. Timothy brings considerable finance, accounting, corporate governance and risk management experience to our Board.

Lesley Thompson. Ms. Thompson has served as the Managing Director of Willis Towers Watson Management (Cayman) Ltd. (“WTW Cayman”) since March 2020 and as Secretary since April 2020. WTW Cayman is part of the Willis Towers Watson group (NASDAQ: WTW). Ms. Thompson is responsible for the strategy and leadership of WTW Cayman providing insurance management and brokerage services to its clients. Ms. Thompson also provides independent director services to insurance and structured finance companies . Ms. Thompson currently serves as a director to ICP Investment Holdings Limited since November 2016 and ICP Reinsurance Limited since January 2017 and Evergreen Pacific Reinsurance Company Limited since August 2019.2017. Ms. Thompson previously served as Vice President of Maples Fiduciary Services (Cayman) Limited from February 2016 to March 2020 where she headed the insurance management services and provided independent director services to insurance and structured finance companies. From January 2000 to January 2016, Ms. Thompson held senior roles of Assistant Vice President, Assistant Manager & Group Vice President at Aon Insurance Managers (Bermuda) Ltd., HSBC Financial Services (Cayman) Ltd., Atlas Insurance Management (Cayman) Ltd. and Advantage International Management (Cayman) Ltd. where she led and managed large portfolios of property & casualty and life & annuity companies, including special purpose vehicles, segregated portfolio companies and group captives. Ms. Thompson has served as a member of the executive committee of The Insurance Managers Association of Cayman since August 2020 and is the currentpast Chairperson. Ms. Thompson is a Chartered Management Accountant (ACMA & CGMA), a Fellow of Captive Insurance (FCI) and holds the Accredited Director (Acc. Dir.) designation through the Chartered Governance Institute of Canada.

Ms. Thompson brings invaluable experience in insurance, accounting and corporate governance to our Board.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT SHAREHOLDERS

VOTE “FOR” THE ELECTION OF EACH OF THE DIRECTOR NOMINEES NAMED ABOVE.

ITEM 1 ON YOUR PROXY CARD.

RATIFICATION OF THE COMPANY’S AUDITORS

Upon recommendation of the Audit Committee of the Company, our Board proposes that the shareholders ratify the appointment of Hacker, Johnson & Smith, P.A. (“Hacker Johnson”) to serve as the independent auditors of the Company for the fiscal year ending December 31, 2023.2024. Hacker Johnson served as the independent auditors of the Company for the fiscal years ended December 31, 2013 through December 31, 2022.2023.

Although ratification is not required by law, our Board believes that shareholders should be given the opportunity to express their views on the subject. In the event of a negative vote on such ratification, the Audit Committee will reconsider its selection. Even if this appointment is ratified, the Audit Committee, in its discretion, may direct the appointment of a different independent registered public accounting firm at any time during the year if the Audit Committee determines that such a change would be in the best interest of the Company and its shareholders.

We do not expect that a representative of Hacker Johnson will attend the Meeting.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT

SHAREHOLDERS VOTE “FOR” THE RATIFICATION OF THE APPOINTMENT OF HACKER

JOHNSON AS THE COMPANY’S AUDITOR.

ITEM 2 ON YOUR PROXY CARD.

ADVISORY VOTE ON THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS

We view executive compensation as an important matter both to us and to our shareholders. As required by Section 14A of the Exchange Act, we are asking shareholders to vote, on a non-binding, advisory basis, on a resolution approving the compensation of our named executive officers as disclosed in the section of this proxy statement entitled “Executive Compensation and Related Information” that follows. This advisory vote on the compensation of our named executive officers allows our shareholders to express their views on our executive compensation programs.

The Board of Directors would like the support of the company’s shareholders for the compensation of our named executive officers as disclosed in this proxy statement. Accordingly, for the reasons discussed above, the Board of Directors recommends that shareholders vote in favor of the following resolution:

“RESOLVED, that the shareholders approve, on an advisory basis, the compensation of the named executive officers as disclosed pursuant to Item 402 of Regulation S-K, including the compensation tables and narrative discussion contained in this proxy statement.”

This advisory vote on the compensation of our named executive officers is not binding on the company, the Board of Directors or the compensation committee of the Board of Directors. However, the Board of Directors and the compensation committee of the Board of Directors will review and consider the outcome of this advisory vote when making future compensation decisions for our named executive officers.

THE BOARD UNANIMOUSLY RECOMMENDS THAT SHAREHOLDERS VOTE “FOR” THE APPROVAL ON A NON-BINDING, ADVISORY BASIS, OF THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS.

ITEM 3 ON YOUR PROXY CARD.

ADVISORY VOTE ON THE FREQUENCY OF FUTURE ADVISORY VOTES ON THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS

Summary

The Company’s shareholders are entitled to vote at the Annual Meeting regarding whether the shareholder vote to approve the compensation of the named executive officers (as described in proposal 3 of this proxy statement) should occur every one, two or three years. Under the rules issued by the SEC, shareholders shall also have the option to abstain from voting on the matter. The shareholder vote on the frequency of the shareholder vote to approve executive compensation is an advisory vote only, and it is not binding on the company or our Board of Directors.

Although the vote is non-binding, our compensation committee and Board of Directors value the opinions of our shareholders and will consider the outcome of the vote when determining the frequency of the shareholder vote on executive compensation.

The Board of Directors has determined that a shareholder advisory vote on executive compensation every three years is the best approach for the company based on a number of considerations, including the following:

THE BOARD UNANIMOUSLY RECOMMENDS THAT THE SHAREHOLDERS VOTE “FOR” THE OPTION OF EVERY THREE YEARS FOR FUTURE ADVISORY VOTES ON THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS.

ITEM 4 ON YOUR PROXY CARD.

CORPORATE GOVERNANCE AND BOARD OF DIRECTORS

Board Leadership Structure and Risk Oversight

Our Company’s Board does not have a current requirement that the roles of Chief Executive Officer and Chairman of the Board be either combined or separated because the Board believes it is in the best interest of our Company to make this determination based upon the position and direction of the Company and the constitution of the Board. The Board regularly evaluates whether the roles of Chief Executive Officer and Chairman of the Board should be combined or separated.

Since the Company’s formation in 2013 through to December 31, 2017, the Company had bifurcated the positions of Chairman of the Board and Chief Executive Officer. Paresh Patel had served as Chairman of the Board since April 2013 through to his resignation in December 2017. Jay Madhu has served as Chief Executive Officer of the Company since April 2013, and took on the additional role of Chairman of the Board effective January 1, 2018.

Our independent directors have determined that the most effective leadership structure for our Company at the present time is for our Chief Executive Officer to also serve as our Chairman of the Board. Our independent directors believe that because our Chief Executive Officer is ultimately responsible for our day-to-day operations and for executing our business strategy, and because our performance is an integral part of the deliberations of our Board, our Chief Executive Officer is the director best qualified to act as Chairman of the Board. Our Board retains the authority to modify this structure to best address our unique circumstances, and so advance the best interests of all stockholders, as and when appropriate.

We have three independent directors and two non-independent directors. We believe that the number of independent, experienced directors on our Board provides the necessary and appropriate oversight for our Company.

Management is primarily responsible for assessing and managing the Company’s exposure to risk. While risk assessment is management’s duty, the Audit Committee is responsible for discussing certain guidelines and policies with management that govern the process by which risk assessment and control is handled. The Audit Committee also reviews steps that management has taken to monitor the Company’s risk exposure. In addition, the Underwriting Committee approves and reviews our underwriting policies and guidelines, oversees our underwriting process and procedures, monitors our underwriting performance and oversees our underwriting risk management exposure. Management focuses on the risks facing the Company, while the Audit Committee and the Underwriting Committee focus on the Company’s general risk management strategies and oversee risks undertaken by the Company. We believe this division of responsibilities is the most effective approach for addressing the risks facing our Company and that our Board leadership structure supports this approach.

Board Committees and Meetings

Our Board has five committees: an Audit Committee, a Compensation Committee, a Nominating and Corporate Governance Committee, an Underwriting Committee and an Investment Committee. Each committee, except for the Investment Committee, has a written charter. The table below provides current membership information for each of the committees.

| Nominating and | Nominating and | ||||||||||||||||||||||||||||||||||

| Audit | Compensation | Corporate Governance | Underwriting | Investment | Audit | Compensation | Corporate Governance | Underwriting | Investment | ||||||||||||||||||||||||||

| Committee | Committee | Committee | Committee | Committee | Committee | Committee | Committee | Committee | Committee | ||||||||||||||||||||||||||

| Jay Madhu | X | X | X | X | |||||||||||||||||||||||||||||||

| Dwight Merren | X | X* | X | ||||||||||||||||||||||||||||||||

| Arun Gowda | X* | X | X | X* | X | X | X | X* | |||||||||||||||||||||||||||

| Wrendon Timothy | X | X | X | X | |||||||||||||||||||||||||||||||

| Lesley Thompson | X | X | X* | X* | X | X | X* | X* | |||||||||||||||||||||||||||

| # of meetings held in 2022 | 4 | 3 | 2 | 4 | 3 | ||||||||||||||||||||||||||||||

| Dwight Merren | X | X* | X | X | |||||||||||||||||||||||||||||||

| # of meetings held in 2023 | 4 | 1 | 1 | 3 | 3 | ||||||||||||||||||||||||||||||

* Committee Chairperson

Our Board held six (6)five (5) meetings in 2022.2023. Each of our directors above attended at least 80% of the meetings of the Board in 2022.2023.

It is our policy that directors are expected to attend the Annual General Meeting of Shareholders in the absence of a scheduling conflict or other valid reason. All of our directors serving at the time of our 20222023 Annual General Meeting of Shareholders attended such meeting.

The Board has determined that (1) Jay Madhu and Wrendon Timothy do not qualify as independent directors under the applicable rules of The Nasdaq Stock Market and the Securities and Exchange Commission (“SEC”) and (2) Arun Gowda, Dwight Merren and Lesley Thompson qualify as independent directors under the applicable rules of The Nasdaq Stock Market and the SEC.

The Board has also determined that all of the current members of the Audit Committee, the Compensation Committee, and the Nominating and Corporate Governance Committee qualify as independent directors under the applicable rules of The Nasdaq Stock Market and SEC and that the current members of the Compensation Committee each qualify as a “non-employee director” as defined in Section 16b-3 of the Exchange Act.

Below is a description of each committee of our Board.

Audit Committee

Our Audit Committee consists of three members – Arun Gowda, Dwight Merren and Lesley Thompson. Each of these individuals meets all independence requirements for Audit Committee members set forth in applicable SEC rules and regulations and the applicable rules of The Nasdaq Stock Market. Arun Gowda serves as Chairman of our Audit Committee and both Arun Gowda and Lesley Thompson qualify as an “audit committee financial expert” as that term is defined in the rules and regulations established by the SEC.

The Audit Committee has general responsibility for the oversight of our accounting, reporting and financial control practices. The Audit Committee is governed by a written charter approved by our Board, which outlines its primary duties and responsibilities, and which can be found on our website at www.oxbridgere.com.

Compensation Committee

Our Compensation Committee currently consists of three members – Dwight Merren, Lesley Thompson and Arun Gowda. Dwight Merren serves as Chairman of our Compensation Committee. All of the current members of our Compensation Committee qualify as independent directors under the applicable rules of The Nasdaq Stock Market and as “non-employee directors” under Section 16b-3 of the Exchange Act.

The purpose of our Compensation Committee is to discharge the responsibilities of our Board relating to compensation of our Chief Executive Officer and to make recommendations to our Board relating to the compensation of our other executive officers. Our Compensation Committee, among other things, assists our Board in ensuring that a proper system of compensation is in place to provide performance-oriented incentives to management. Our Compensation Committee has the authority to delegate its responsibilities to a subcommittee or to officers of the Company to the extent permitted by applicable law and the compensation plans of the Company if it determines that such delegation would be in the best interest of the Company. Our Compensation Committee from time to time may engage a compensation consultant; however, it did not engage a compensation consultant with respect to executive or director compensation for 2022. However, our Compensation Committeeand engaged Zayla Partners, LLC as a compensation consultant with respect to executive and director compensation for 2023.

The Compensation Committee is governed by a written charter approved by our Board, which outlines its primary duties and responsibilities, and which can be found on our website at www.oxbridgere.com.

Nominating and Corporate Governance Committee

Our Nominating and Corporate Governance Committee is composed of three members – Arun Gowda, Lesley Thompson and Dwight Merren. Lesley Thompson serves as the Chair of our Nominating and Corporate Governance Committee. All of the members of our Nominating and Corporate Governance Committee qualify as independent directors under the applicable rules of The Nasdaq Stock Market and as “non-employee directors” under Section 16b-3 of the Exchange Act.

The Nominating and Corporate Governance Committee makes recommendations to our Board as to nominations for our Board and committee members, as well as with respect to structural, governance and procedural matters. The Nominating and Corporate Governance Committee also reviews the performance of our Board and the Company’s succession planning. The Nominating and Corporate Governance Committee is governed by a written charter approved by our Board, which outlines its primary duties and responsibilities, and which can be found on our website at www.oxbridgere.com.

The Nominating and Corporate Governance Committee is responsible for reviewing the criteria for the selection of new directors to serve on the Board and reviewing and making recommendations regarding the composition and size of the Board. When our Board decides to seek a new member, whether to fill a vacancy or otherwise, the Nominating and Corporate Governance Committee will consider recommendations from other directors, management and others, including shareholders. In general, the Nominating and Corporate Governance Committee looks for directors possessing superior business judgment and integrity who have distinguished themselves in their chosen fields and who have knowledge or experience in the areas of insurance, reinsurance, financial services or other aspects of the Company’s business, operations or activities. In selecting director candidates, the Nominating and Corporate Governance Committee also considers the interplay of the candidate’s experience with the experience of the other Board members, as well as diversity of director candidates.

While we do not have an official policy, the Nominating and Corporate Governance Committee will consider, for director nominees, persons recommended by shareholders, who may submit recommendations to the Nominating and Corporate Governance Committee in care of the Company’s Secretary, at Suite 201, 42 Edward Street, P.O. Box 469, Grand Cayman, KY1-9006, Cayman Islands. To be considered by the Nominating and Corporate Governance Committee, such recommendations must be accompanied by a description of the qualifications of the proposed candidate and a written statement from the proposed candidate that he or she is willing to be nominated and desires to serve if elected. Nominees for director who are recommended by shareholders to the Nominating and Corporate Governance Committee will be evaluated in the same manner as any other nominee for director.

We do not have a policy regarding the consideration of any director candidates that may be recommended by our shareholders, including the minimum qualifications for director candidates, nor has our Board established a process for identifying and evaluating director nominees. We have not adopted a policy regarding the handling of any potential recommendation of director candidates by our shareholders, including the procedures to be followed. Our Board has not considered or adopted any of these policies, as we have never received a recommendation from any shareholder for any candidate to serve on our Board. While there have been no nominations of additional directors proposed, in the event such a proposal is made, our current board will participate in the consideration of director nominees.

Underwriting Committee

The Underwriting Committee consists of three members – Lesley Thompson, Jay Madhu and Wrendon Timothy. Lesley Thompson serves as Chairman of our Underwriting Committee. The Underwriting Committee’s responsibilities include approving and reviewing our underwriting policies and guidelines, overseeing our underwriting process and procedures, monitoring our underwriting performance and overseeing our underwriting risk management exposure. The Underwriting Committee is governed by a written charter approved by our Board, which outlines its primary duties and responsibilities, and which can be found on our website at www.oxbridgere.com.

| 10 |

Investment Committee

The Investment Committee consists of three members – Arun Gowda, Wrendon Timothy and Jay Madhu. Arun Gowda serves as Chairman of the Investment Committee. The Investment Committee’s responsibilities include approving and reviewing any changes to our investment guidelines, and monitoring investment performance and market, credit and interest rate exposure as a result of opportunistic investment decisions undertaken by management. The Investment Committee is governed by investment guidelines that have been approved by our Board. There is no written charter for the Investment Committee.

Code of Ethics

Our Board has adopted a written Code of Business Conduct and Ethics that applies to our principal executive officer, principal financial officer, principal accounting officer or controller or persons performing similar functions. We have posted a current copy of the code on our website, www.oxbridgere.com, in the “Investor Information” section of the website. We intend to disclose any change to or waiver from our Code of Business Conduct and Ethics by posting such change or waiver to our internet web site within the same section as described above.

Anti-Hedging Policy

Our Board has adopted an Insider Trading Policy, which applies to all of our directors, officers and employees, as well as their family members and entities under their control. The policy prohibits such persons and entities from engaging in hedging transactions involving our equity securities, such as prepaid variable forward contracts, equity swaps, collars and exchange funds, or other transactions that hedge or offset, or are designed to hedge or offset, any decrease in the market value of our equity securities.

Clawback Policy

In accordance with SEC and Nasdaq requirements, our Board has adopted an executive compensation recovery policy regarding the adjustment or recovery of certain incentive awards or payments made to current or former executive officers in the event that we are required to prepare an accounting restatement due to material noncompliance with any financial reporting requirement under the securities laws. In general, the policy provides that, unless an exception applies, we will seek to recover compensation that is awarded to an executive officer based on the Company’s attainment of a financial metric during the three-year period prior to the fiscal year in which the restatement occurs, to the extent such compensation exceeds the amount that would have been awarded based on the restated financial results. A copy of the clawback policy is filed as an Exhibit 97.1 to the 2023 Annual Report.

Board Diversity Matrix

Each of our directors possesses certain experience, qualifications, attributes and skills, as further described above, that led to our conclusion that he or she should serve as a member of the Board. In addition to the foregoing biographical information with respect to each of our directors, the following tables evidences additional diversity, experience and qualifications of our individual directors.

| Board Diversity Matrix (as of April 24, 2023) | ||||||||||||||||

| Total Number of Directors | 5 | |||||||||||||||

| Female | Male | Non-Binary | Did Not Disclose Gender | |||||||||||||

| Part I: Gender Identity | ||||||||||||||||

| Directors | 1 | 4 | - | - | ||||||||||||

| Part II: Demographic Background | ||||||||||||||||

| African American or Black | - | 1 | - | - | ||||||||||||

| Alaskan Native or Native American | - | - | - | |||||||||||||

| Asian | - | 2 | - | - | ||||||||||||

| Hispanic or Latinx | - | - | - | |||||||||||||

| Native Hawaiian or Pacific Islander | - | - | - | - | ||||||||||||

| White | 1 | 1 | - | - | ||||||||||||

| Two or More Races or Ethnicities | - | - | - | - | ||||||||||||

| LGBTQ | - | |||||||||||||||

| Did Not Disclose Demographic Background | - | |||||||||||||||

| Board Diversity Matrix (as of April 29 2024) | ||||||||||||||||

| Total Number of Directors | 5 | |||||||||||||||

| Female | Male | Non-Binary | Did Not Disclose Gender | |||||||||||||

| Part I: Gender Identity | ||||||||||||||||

| Directors | 1 | 4 | - | - | ||||||||||||

| Part II: Demographic Background | ||||||||||||||||

| African American or Black | - | 1 | - | - | ||||||||||||

| Alaskan Native or Native American | - | - | - | |||||||||||||

| Asian | - | 2 | - | - | ||||||||||||

| Hispanic or Latinx | - | - | - | |||||||||||||

| Native Hawaiian or Pacific Islander | - | - | - | - | ||||||||||||

| White | 1 | 1 | - | - | ||||||||||||

| Two or More Races or Ethnicities | - | - | - | - | ||||||||||||

| LGBTQ | - | |||||||||||||||

| Did Not Disclose Demographic Background | - | |||||||||||||||

All directors, other than Mr. Madhu and Mr. Timothy, are entitled to receive compensation from us for their services as directors. Under the Articles, our directors may receive compensation for their services as may be determined by our Board. As further discussed in the “Executive Compensation” section below, the Committee recently retained the services of an outside, independent compensation consultant to advise on compensation practices for the Company. The Committee is leveraging the independent consultant’s insights going forward on both executive and board of director compensation.

The following table sets forth information with respect to compensation earned by each of our directors (other than employee directors) during the year ended December 31, 2022.2023.

| Name | Fees Earned or Paid In Cash (1) | Stock Awards (2) | Option Awards (3) | Non-Equity Incentive Plan Compensation | Change in Pension Value And Nonqualified Deferred Compensation Earnings | All Other Compensation | Total | Fees Earned or Paid In Cash (1) | Stock Awards (2) | Option Awards | Non-Equity Incentive Plan Compensation | Change in Pension Value And Nonqualified Deferred Compensation Earnings | All Other Compensation | Total | ||||||||||||||||||||||||||||||||||||||||||

| Raymond Cabillot | $ | - | $ | 108,800 | $ | - | - | - | - | $ | 108,800 | |||||||||||||||||||||||||||||||||||||||||||||

| Krishna Persaud (4) | $ | - | $ | 108,800 | $ | - | - | - | - | $ | 108,800 | |||||||||||||||||||||||||||||||||||||||||||||

| Arun Gowda | $ | 15,000 | $ | 25,000 | $ | - | - | - | - | $ | 40,000 | |||||||||||||||||||||||||||||||||||||||||||||

| Lesley Thompson | $ | - | $ | - | $ | - | - | - | - | $ | - | $ | 15,000 | $ | 25,000 | $ | - | - | - | - | $ | 40,000 | ||||||||||||||||||||||||||||||||||

| Dwight Merren | $ | - | $ | - | $ | - | - | - | - | $ | - | $ | 15,000 | $ | 25,000 | $ | - | - | - | - | $ | 40,000 | ||||||||||||||||||||||||||||||||||

| (1) | During |

| (2) | All stock awards were granted under our Non-Employee Director Compensation Program adopted under our 2021 Omnibus Incentive Plan. The value reported above in the “Stock Awards” column is the aggregate grant date fair value for the NEO’s option awards granted in |

The aggregate number of stock awards outstanding for each non-employee director as of December 31, 20212023 was as follows:

| Number of | ||||||||

| Number | Restricted | |||||||

| Name | of Options | Shares | ||||||

| Raymond Cabillot | 25,000 | 16,000 | ||||||

| Lesley Thompson | - | 16,000 | ||||||

| Dwight Merren | - | - | ||||||

| Number of | ||||||||

| Number | Restricted | |||||||

| Name | of Options | Shares | ||||||

| Arun Gowda | - | 10,549 | ||||||

| Lesley Thompson | - | 26,549 | ||||||

| Dwight Merren | - | 10,549 | ||||||

Our Board has adopted a policy for handling shareholder communications to directors. Shareholders may send written communications to our Board or any one or more of the individual directors by mail, c/o Secretary, Oxbridge Re Holdings Limited, Suite 201, 42 Edward Street, P.O. Box 469, Grand Cayman, KY1-9006, Cayman Islands. There is no screening process, other than to confirm that the sender is a shareholder and to filter inappropriate materials and unsolicited materials of a marketing or publication nature. All shareholder communications that are received by the Secretary of the Company for the attention of a director or directors are forwarded to such director or directors.

The below table lists our executive officers. Additional information about each executive officer can be found under “Director Nominees” above. There is no family relationship among any of the directors and/or executive officers of the company.

| Name | Age | Position | Position Since | |||

| Jay Madhu* | 56 | Chief Executive Officer, President and Chairman of the Board (Principal Executive Officer) | 2013 | |||

| Wrendon Timothy* | 42 | Chief Financial Officer and Secretary (Principal Financial and Accounting Officer) | 2013 |

| Name | Age | Position | Position Since | |||

| Jay Madhu* | 57 | Chief Executive Officer, President and Chairman of the Board (Principal Executive Officer) | 2013 | |||

| Wrendon Timothy* | 43 | Chief Financial Officer and Secretary (Principal Financial and Accounting Officer) | 2013 |

* See biography above under “Director Nominees”

| 13 |

Report of the Compensation Committee

We are considered a “smaller reporting company” for purposes of the SEC’s executive compensation and other disclosure rules. In accordance with such rules, we are required to provide a Summary Compensation Table and an Outstanding Equity Awards at Fiscal Year End Table, as well as limited narrative disclosures. The Compensation Committee (the Committee) has reviewed and discussed with management the Compensation Discussion and Analysis appearing immediately below in this Proxy Statement. Based on this review and discussion, the Committee has recommended to the Board that the Compensation Discussion and Analysis set forth below be included in this Proxy Statement.

By the Compensation Committee:

Dwight Merren, Chair

Arun Gowda and Lesley Thompson

Executive Summary

This narrative discussion of our named executive compensation program is intended to assist your understanding of, and to be read in conjunction with, the Summary Compensation Table and related disclosures set forth below.

For the 20222023 fiscal year, our named executive officers were as follows:

| ● | Jay Madhu, our Chief Executive Officer, President and Chairman of the Board | |

| ● | Wrendon Timothy, our Chief Financial Officer, Director and Secretary |

Overview and Objectives of Our Executive Compensation Program

Through our executive compensation program, we seek to align our executive officers’ interests and motivations with those of our stockholders by rewarding both short-term and long-term objectives. We believe that the overall compensation of our executive officers should provide a competitive level of total compensation that enables us to attract, retain and incentivize highly qualified executive officers with the background and experience necessary to lead the company and achieve its business goals.

For the first time, the Compensation Committee engaged an outside, independent compensation consultant to assist in the development of the Company’s compensation programs for both the executives and independent members of the Board of Directors. As the Company continues to grow and evolve the Compensation Committee and Board intends to continue to review and modify our compensation policies to ensure that we attract, motivate and retain highly skilled executives and employees to execute on our strategic objectives.

Benchmarking, Consultants and Compensation Peer Group

As noted above, for the first time the Compensation Committee engaged an independent third-party compensation consultant, Zayla Partners, LLC (“Zayla”), to assist the Compensation Committee in addressing matters of compensation and benefits, and to identify peer group companies based on critical industry and size criteria. The Company recognizes that compensation practices must be competitive in the marketplace and marketplace information is one of the many factors that are considered in assessing the reasonableness of compensation programs. While the Committee has requested the data and guidance provided by Zayla, the Compensation Committee retains the discretion to make all final decisions relative to matters of compensation and benefits.

In 2022, theThe Committee engaged Zayla to provide benchmarking for the Company’s NEOs for fiscal 2023 and prospectively, based on the use of 2022 data from the peer group of companies shown below. The overall compensation programs for the Company’s NEOs are designed to reward achievement of performance and to attract, retain, and motivate them in an increasingly competitive talent market. The Compensation Committee examined compensation data for the peer group of companies shown below to stay current with market pay practices and trends and to understand the competitiveness of our overall executive compensation programs and their various elements. The Committee used this benchmarking data for informational purposes. It does not formulaically target a specific percentile or make significant compensation decisions based on market data or peer group benchmarking data alone, which avoids a “ratcheting up” impact. The Committee uses performance as a primary driver of compensation levels. The peer group companies consisted of:

Atlantic American Corporation

Conifer Holdings, Inc.

FG Financial Group, Inc.

ICC Holdings, Inc.

Kingstone Companies, Inc.

Marpai, Inc.

Reliance Global Group, Inc.

Unico American Corporation

From time to time, the Compensation Committee may supplement its business judgment pertaining to its consideration of the Company’s compensation matters, including salary amounts, short-term and long-term incentive plan minimum and incremental payout thresholds and targets, with a variety of market information obtained from a number of different sources including, among other things, the Compensation Committee’s general knowledge regarding compensation matters, information from one or more independent compensation consultants, peer company data, benchmarking related to that data, information obtained from independent search firms, historical and current Company compensation data, and historical, current and projected industry and Company financial operational performance data and trends.

Compensation Elements

We seek to align our executive officers’ interests and motivations with those of our stockholders. Typically, this is done using the following key compensation elements: base salary, short-term incentives and long-term incentives, as more fully described below. Among those three elements, from year to year, when considering its goal of promoting the overall financial performance of the Company on an annual and long-term basis, the use by the Committee of any or the extent of use of the short-term and long-term incentives described below may vary, but when used in the compensation packages for NEOs retain the pay-for-performance characteristics described below.

Base Salary

The employment agreements with our named executive officers (as described below in “Employment Agreements”) entitle our executive officers to receive a base salary, that may be increased from time to time. The base salaries of our named executive officers in fiscal year 20222023 were:

| Name of Executive | Position | Base Salary ($) | Position | Base Salary ($) | ||||||||

| Jay Madhu | Chief Executive Officer, President and Chairman of the Board (Principal Executive Officer) | $ | 285,000 | Chief Executive Officer, President and Chairman of the Board (Principal Executive Officer) | $ | 300,000 | ||||||

| Wrendon Timothy | Chief Financial Officer and Secretary (Principal Financial and Accounting Officer) | $ | 162,000 | Chief Financial Officer and Secretary (Principal Financial and Accounting Officer) | $ | 195,000 | ||||||

Annual Incentive Compensation

Our named executive officers are eligible to receive annually a discretionary cash bonus based on the financial performance of the Company as well as individual performance of each executive officer. In determining whether our executives were eligible for a bonus in fiscal year 2022,2023, our Compensation Committee considered each officer’s performance in achieving the company’s strategic objectives during 2022,2023, the stock price performance of the Company and the total compensation of each executive officer. Accordingly, the Compensation Committee elected not to award cash bonus awards to our named executive officers in fiscal year 2022.2023.

Equity Compensation

To align compensation with long-term performance, our equity compensation plan allows for the grant of stockshare options, restricted stockshare units and restricted stockshare awards to our named executive officers and other employees. Each named executive officer is eligible to be considered for an annual equity award.

For the fiscal year 2022, the Committee did not grant any equity awardsIn January 2023, pursuant to our named executive officers. However, as discussed further below in “Material Compensation Actions Since Year-End,”officer employment agreements, the Committee granted 40,000 and 25,000 restricted shares awards to named executive officers in early fiscal year 2023.Mr. Madhu and Mr. Timothy, respectively.

Employment Agreements

Each of our named executive officers is party to employment agreements that entitle them to certain elements of compensation and govern the terms of their employment with the Company, as described in more detail below. Pursuant to their employment agreements, the named executive officers are eligible to participate in the employee benefits programs we provide to all of our employees, including medical, dental, vision, life, and disability insurance, to the same extent made available to other employees, subject to applicable law. There are no additional benefits or perquisites applicable exclusively to any of the named executive officers.

Pursuant to the employment agreements, the named executive officers are subject to perpetual confidentiality restrictions and non-disparagement provisions, and non-solicitation restrictions with respect to the Company’s employees and customers and non-competition restrictions, in each case, for the duration of their employment and specified time thereafter.

The Company entered into amended and restated employment agreements with both Messrs. Madhu and Timothy on January 9, 2023. For more detail, please refer to the descriptions below in “Material Compensation Actions Since Year-End.”

Material Compensation Actions Since Year-EndJay Madhu

On January 9, 2023, the Company tookentered into an Amended and Restated Employment Agreement with Mr. Madhu, with a term through December 31, 2025, and automatic renewals for additional successive 1-year terms unless notice of non-renewal is provided by the following actions:

| Company or Mr. Madhu at least ninety days prior to the renewal date. Under the terms of Mr. Madhu’s employment agreement, Mr. Madhu is currently paid a base salary of $312,500 per annum, payable monthly and adjustable annually, and an opportunity to be granted an annual incentive bonus at the discretion of the Board and participate in the Company’s equity incentive plan on the same terms as other senior executives. As such, the Company will annually grant to the executive 40,000 restricted shares under the 2021 Omnibus Plan, which |

In accordance with the employment agreements outlined above, on January 9, 2023, the Board granted 40,000 and 25,000 restricted ordinary shares to Mr. Madhu and Mr. Timothy, respectively. The ordinary shares were granted under our 2021 Omnibus Plan, and will vest ratably on the first day of each calendar quarter over the 4 calendar quarters immediately following the grant date, contingent on Mr. Madhu’s and Mr. Timothy’s continuous employment or service with the Company until the applicable vesting date.

Mr. Madhu is eligible to participate in all of the Company’s pension, life insurance, health insurance, disability insurance and other benefit plans on the same basis as the Company’s other employee officers participate; entitled to a lump sum M&A transaction bonus of seven percent of the transaction value of certain mergers, stock sales, asset sales, or similar transactions by the Company or its subsidiaries; entitled to a lump sum payment equal to his base salary otherwise payable under the agreement for a three year severance period if terminated “without cause” or if he terminates his own employment for a “good reason event”, as those terms are defined in the agreement, in addition to any target bonus, restricted share award and M&A transaction bonus that would have been payable under the agreement during the applicable periods following the termination date; and subject to certain non-competition covenants and confidentiality provisions that the executive will abide by.

Wrendon Timothy

On January 9, 2023, the Company entered into an Amended and Restated Employment Agreement with Mr. Timothy, with a term through December 31, 2025, and automatic renewals for additional successive 1-year terms unless notice of non-renewal is provided by the Company or Mr. Timothy at least ninety days prior to the renewal date. Under the terms of Mr. Timothy’s employment agreement, Mr. Timothy is currently paid a base salary of $212,500 per annum, payable monthly and adjustable annually, and an opportunity to be granted an annual incentive bonus at the discretion of the Board and participate in the Company’s equity incentive plan on the same terms as other senior executives. As such, the Company will annually grant to the executive 25,000 restricted shares under the 2021 Omnibus Plan, which will vest ratably on the first day of each calendar quarter over the 4 calendar quarters immediately following the grant date.

Mr. Timothy is eligible to participate in all of the Company’s pension, life insurance, health insurance, disability insurance and other benefit plans on the same basis as the Company’s other employee officers participate; entitled to a lump sum M&A transaction bonus of three percent of the transaction value of certain mergers, stock sales, asset sales, or similar transactions by the Company or its subsidiaries; entitled to a lump sum payment equal to his base salary otherwise payable under the agreement for a three year severance period if terminated “without cause” or if he terminates his own employment for a “good reason event”, as those terms are defined in the agreement, in addition to any target bonus, restricted share award and M&A transaction bonus that would have been payable under the agreement during the applicable periods following the termination date; and subject to certain non-competition covenants and confidentiality provisions that the executive will abide by.

| 16 |

The following table summarizes the compensation of our Named Executive Officers, or “NEOs”, in 2022 and 2021.

| Name and Principal Position | Year | Salary | Bonus | Stock Awards | Option Awards(1) | Non-Equity Incentive Plan Compensation | Nonqualified Deferred Compensation Earnings | All Other Compensation(2) | Total | Year | Salary | Bonus | Stock Awards(1) | Option Awards | Non-Equity Incentive Plan Compensation | Nonqualified Deferred Compensation Earnings | All Other Compensation(2) | Total | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Jay Madhu | 2022 | $ | 285,000 | - | - | - | - | - | $ | 5,305 | $ | 290,305 | 2023 | $ | 300,000 | - | 94,800 | - | - | - | $ | 5,305 | $ | 400,105 | ||||||||||||||||||||||||||||||||||||||||||||||||

| President and Chief Executive Officer | 2021 | $ | 232,000 | $ | - | - | 55,895 | - | - | $ | 5,305 | $ | 293,200 | 2022 | $ | 285,000 | - | - | - | - | - | $ | 5,305 | $ | 290,305 | |||||||||||||||||||||||||||||||||||||||||||||||

| Wrendon Timothy | 2022 | $ | 162,000 | - | - | - | - | - | $ | 5,305 | $ | 167,305 | 2023 | $ | 195,000 | - | 59,250 | - | - | - | $ | 5,305 | $ | 259,555 | ||||||||||||||||||||||||||||||||||||||||||||||||

| Chief Financial Officer and Corporate Secretary | 2021 | $ | 132,000 | $ | - | - | 23,955 | - | - | $ | 5,305 | $ | 161,260 | 2022 | $ | 162,000 | - | - | - | - | - | $ | 5,305 | $ | 167,305 | |||||||||||||||||||||||||||||||||||||||||||||||

| (1) | All |

| (2) | In both |

GRANTS OF PLAN BASED AWARDS IN FISCAL YEAR 2022

Our Compensation Committee, or our Board of Directors acting as our Compensation Committee may grant stockshare options or restricted stockshare awards under our 2021 Omnibus Incentive Plan. There were no awards of stock options or restricted stock to NEOs during 2022.

| Grant Date | Approval Date | Estimated Future Payouts Under Non-Equity Incentive Plan Awards | Estimated Future Payouts Under Equity Incentive Plan Awards | All other Stock Awards: Number of Shares of Stock or Units (#)(1) | All other Option Awards: Number of Securities Underlying Options (#) | Exercise or Base Price of Option Awards ($/Sh) | Grant Date Fair Value of Stock and Option Awards ($)(2) | |||||||||||||||||||||

| Jay Madhu | 1/9/2023 | 1/9/2023 | - | - | 40,000 | - | $ | 0.00 | 94,800 | |||||||||||||||||||

| Wrendon Timothy | 1/9/2023 | 1/9/2023 | - | - | 25,000 | - | $ | 0.00 | 59,250 | |||||||||||||||||||

| (1) | The amount represents a grant of restricted shares made pursuant to our 2021 Omnibus Incentive Plan. The shares are subject to forfeiture upon termination of employment and restriction of transfer, and will vest ratably on the first day of each calendar quarter over the 4 calendar quarters immediately following the grant date, contingent on Mr. Madhu’s and Mr. Timothy’s continuous employment or service with the Company until the applicable vesting date. The shares were granted conditioned on service to the company and carry all the rights of a shareholder, including the right to receive dividends at the same rate applicable to all common shareholders. |

| (2) | The amounts reflect the aggregate grant date fair value for each NEO’s restricted share awards granted in 2024, determined in accordance with FASB ASC Topic 718, “Compensation—Stock Compensation”. |

OUTSTANDING EQUITY AWARDS AT FISCAL YEAR-END 20222023

The following table sets forth information regarding outstanding stock option and restricted stock awards held by our NEOs at December 31, 2022,2023, including the number of shares underlying both exercisable and unexercisable portions of each option as well as the exercise price and expiration date of each outstanding option:

| Name | Number of Securities Underlying Unexercised Options Exercisable (#) | Number of Securities Underlying Unexercised Options Unexercisable (#) | Equity Incentive Plan Awards: Number of Securities Underlying Unexercised Unearned Options (#) | Option Exercise Price ($) | Option Expiration Date | Number of Shares or Units of Stock That Have Not Vested (#) | Market Value of Shares or Units of Stock That Have Not Vested ($) | Equity Incentive Plan Awards: Number of Unearned Shares, Units or Other Rights That Have Not Vested (#) | Equity Incentive Plan Awards: Market or Payout Value of Unearned Shares, Units or Other Rights That Have Not Vested ($) | Number of Securities Underlying Unexercised Options Exercisable (#) | Number of Securities Underlying Unexercised Options Unexercisable (#) | Equity Incentive Plan Awards: Number of Securities Underlying Unexercised Unearned Options (#) | Option Exercise Price ($) | Option Expiration Date | Number of Shares or Units of Stock That Have Not Vested (#) | Market Value of Shares or Units of Stock That Have Not Vested ($) | Equity Incentive Plan Awards: Number of Unearned Shares, Units or Other Rights That Have Not Vested (#) | Equity Incentive Plan Awards: Market or Payout Value of Unearned Shares, Units or Other Rights That Have Not Vested ($) | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Jay Madhu | 120,000 | (1) | - | - | $ | 6.00 | 1/23/2025 | - | - | - | - | 120,000 | (1) | - | - | $ | 6.00 | 1/23/2025 | - | - | - | - | ||||||||||||||||||||||||||||||||||||||||||||||||

| 25,000 | - | - | $ | 6.00 | 1/16/2026 | - | - | - | - | 25,000 | - | - | $ | 6.00 | 1/16/2026 | - | - | - | - | |||||||||||||||||||||||||||||||||||||||||||||||||||

| 25,000 | - | - | $ | 6.06 | 1/20/2027 | - | - | - | - | 25,000 | - | - | $ | 6.06 | 1/20/2027 | - | - | - | - | |||||||||||||||||||||||||||||||||||||||||||||||||||

| 200,000 | - | - | $ | 2.00 | 3/16/2029 | - | - | - | - | 200,000 | - | - | $ | 2.00 | 3/16/2029 | - | - | - | - | |||||||||||||||||||||||||||||||||||||||||||||||||||

| 87,500 | 87,500 | - | $ | 6.00 | 3/2/2031 | - | - | - | - | 131,250 | 43,750 | - | $ | 6.00 | 3/2/2031 | - | - | - | - | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Wrendon Timothy | 60,000 | (2) | - | - | $ | 6.00 | 1/23/2025 | - | - | - | - | 60,000 | (2) | - | - | $ | 6.00 | 1/23/2025 | - | - | - | - | ||||||||||||||||||||||||||||||||||||||||||||||||

| 10,000 | - | - | $ | 6.00 | 1/16/2026 | - | - | - | - | 10,000 | - | - | $ | 6.00 | 1/16/2026 | - | - | - | - | |||||||||||||||||||||||||||||||||||||||||||||||||||

| 10,000 | - | - | $ | 6.06 | 1/20/2027 | - | - | - | - | 10,000 | - | - | $ | 6.06 | 1/20/2027 | - | - | - | - | |||||||||||||||||||||||||||||||||||||||||||||||||||

| 90,000 | - | - | $ | 2.00 | 3/16/2029 | - | - | - | - | 90,000 | - | - | $ | 2.00 | 3/16/2029 | - | - | - | - | |||||||||||||||||||||||||||||||||||||||||||||||||||

| 37,500 | 37,500 | - | $ | 6.00 | 3/2/2031 | - | - | - | - | 56,250 | 18,750 | - | $ | 6.00 | 3/2/2031 | - | - | - | - | |||||||||||||||||||||||||||||||||||||||||||||||||||

| (1) | Mr. Madhu was awarded 120,000 stock options on January 23, 2015, 25,000 stock options on January 16, 2016, 25,000 stock options on January 20, 2017 and 200,000 stock options on March 16, 2019, all of which have fully vested. Mr. Madhu was awarded 175,000 stock options on March 2, 2021. The options vest quarterly in increments of 10,937.50. The remaining |

| (2) | Mr. Timothy was awarded 60,000 stock options on January 23, 2015, 10,000 stock options on January 16, 2016, 10,000 stock options on January 20, 2017 and 90,000 options on March 16, 2019, all of which have fully vested. Mr. Timothy was awarded 75,000 stock options on March 2, 2021. The options vest quarterly in increments of 4,687.50. The remaining |

| 18 |

OPTION EXERCISES AND STOCK VESTED IN FISCAL 20222023

There were noThe following table sets forth information regarding stock awards vesting or options exercisedvested by our NEO’sNEOs during the year ended December 31, 2022.2023. There were no options exercised by our named executive officers in 2023.

| Option Awards | Stock Awards | |||||||||||||||

| Name | Number of Shares Acquired on Exercise (#) | Value Realized on Exercise ($) | Number of Shares Acquired On Vesting (#) | Value Realized on Vesting ($) (1) | ||||||||||||

| Jay Madhu | - | - | 40,000 | $ | 61,600 | |||||||||||

| Wrendon Timothy | - | - | 25,000 | $ | 38,500 | |||||||||||

(1) Based upon the closing share price on the dates upon which the shares vested.

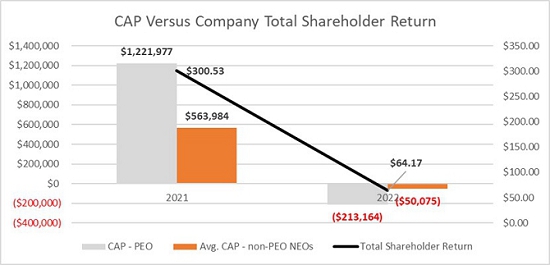

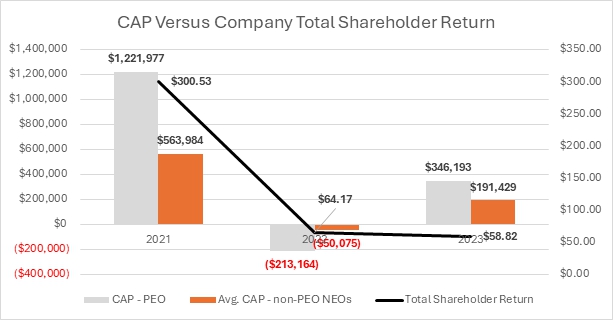

PAY VERSUS PERFORMANCE

As required by Section 953(a) of the Dodd-Frank Wall Street Reform and Consumer Protection Act and Item 402(v) of Regulation S-K, we are providing the following information about the relationship between executive compensation actually paid and certain financial performance of our company.

Year (a) | Summary Compensation Table Total for Principal Executive Officer (“PEO”) (1) (b) | Compensation Actually Paid to PEO (2) (c) | Average Summary Compensation Table Total for Non-PEO Named Executive Officers (“NEOs”) (3) (d) | Average Compensation Actually Paid to Non-PEO NEOs (4) (e) | Value of Initial Fixed $100 Investment Based on Total Shareholder Return (5) (f) | Net Income (Loss) (millions) (6) (h) | Summary Compensation Table Total for Principal Executive Officer (“PEO”) (1) (b) | Compensation Actually Paid to PEO (2) (c) | Average Summary Compensation Table Total for Non-PEO Named Executive Officers (“NEOs”) (3) (d) | Average Compensation Actually Paid to Non-PEO NEOs (4) (e) | Value of Initial Fixed $100 Investment Based on Total Shareholder Return (5) (f) | Net Income (Loss) (millions) (6) (h) | ||||||||||||||||||||||||||||||||||||

| 2023 | $ | 400,105 | $ | 346,193 | $ | 259,555 | $ | 191,429 | $ | 58.82 | $ | (9.91 | ) | |||||||||||||||||||||||||||||||||||

| 2022 | $ | 290,305 | $ | (213,164 | ) | $ | 167,305.00 | $ | (50,075 | ) | $ | 64.17 | $ | (1.79 | ) | $ | 290,305 | $ | (213,164 | ) | $ | 167,305 | $ | (50,075 | ) | $ | 64.17 | $ | (1.79 | ) | ||||||||||||||||||